Just updated: 50+ Ways to Make Money (including 30+ work from home jobs)

More ways to make money:

FlexJobs – Find remote and flexible jobs in over 50 career fields from all over the world.

Swagbucks – Earn free gifts and cash-back rebates by searching the web, playing games, watching videos, shopping, and more.

Writers Work – Find freelance writing jobs and publish your articles, all while working from home.

Public.com – Get free stock just for signing up for this investment app.

Return on capital. Margin of safety. Net operating income.

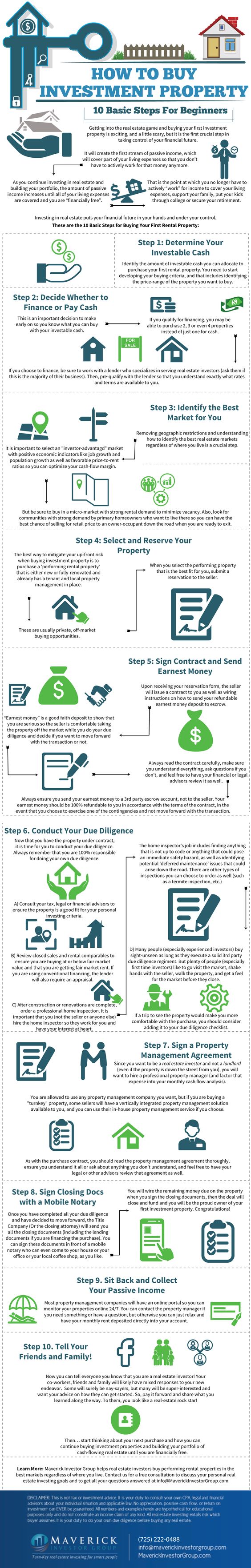

If you’re staring blankly at the screen trying to parse the meaning of those terms, you’re not alone. Everyone’s investment journey has to begin somewhere, but before long, you’ll master the jargon. You can power ahead if you’re willing to follow the 10 steps outlined below.

Investing your money can feel daunting. You might not know where or how to start, especially if you’re interested in the real estate market. Should you finance or pay in cash? Does everything really have to be notarized? How much are you willing to invest in the first place?

You are in control, but that doesn’t mean you have to figure it out all on your own. Luckily, Maverick Investor Group has put together a seamless step-by-step guide to property investing as a beginner, from identifying the best markets to raking in that sweet, sweet passive income. Remember to conduct your due diligence before signing an agreement, and don’t worry about picking up the lingo—you’ll be explaining equity, appreciation, and debt-to-income ratio to your friends before you know it.