Just updated: 50+ Ways to Make Money (including 30+ work from home jobs)

More ways to make money:

FlexJobs – Find remote and flexible jobs in over 50 career fields from all over the world.

Swagbucks – Earn free gifts and cash-back rebates by searching the web, playing games, watching videos, shopping, and more.

Writers Work – Find freelance writing jobs and publish your articles, all while working from home.

Public.com – Get free stock just for signing up for this investment app.

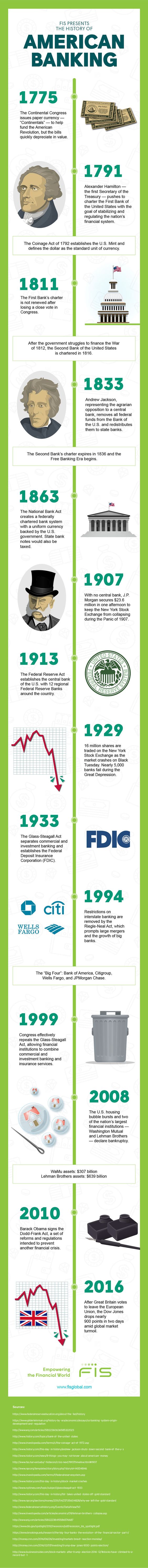

You might recognize the name J.P. Morgan from the top right corner of your credit card or the name Alexander Hamilton from one of the most popular stage musicals of all time, but could you actually explain their contributions to the U.S. banking system? What do they have to do with the Glass-Steagall Act? What is the Glass-Steagall Act, anyway?

If you don’t have the answers ready to access in your brain, it’s likely that you are not familiar with the history of banking.

To understand the current economic situation, it’s incredibly useful to go back in time to see how we got here. From the first paper currency issued after the American Revolution (not yet called “dollars”) to the global market turmoil at the turn of the 21st century, the history of banking is storied and salacious, an ongoing interplay of power, prestige, and poorly thought-out regulations.

For a better grasp on how the past informs the economic present, check out the timeline below from financial services corporation FIS Global. Someone call Lin-Manuel Miranda—we sense a new Broadway hit in the making!